Click Here to Download PDF |

Accounting for Breweries

Here at Upside Accounting one of our niche markets is craft breweries. One of our partners, Adam Wilson is a passionate home brewer and has developed an intricate understanding of how breweries work on both an operational and financial level. He knows the equipment required to launch a brewing business as well as how to brew the beer, ferment it, package it and age it.

The industry is booming with consumers switching from mainstream beer brands in big numbers. Recent statistics from Roy Morgan Research suggest the number of Australians consuming craft beer (on an average four week period) has increased to more than a million for the first time on record. These are staggering numbers and prove that brewing is no longer a cottage industry. In fact, it’s big business and the industry keeps evolving with new technology and plenty of new competitors.

A

dam says, “Running a brewery is not all beer and skittles. You simply can’t afford to make mistakes with any of the stages in

the brewing process (milling, mashing, lautering, boiling, fermenting, conditioning, filtering and packaging) and transporting your brew to a

supplier is another logistical challenge. Many breweries are local family based operations and because of their size they’re limited

in terms of where they can actually distribute their beers. Logistics can be a nightmare and life as an online retailer is certainly tough

but building up brand awareness is a stumbling block for many operators. It’s no surprise to find proprietors regularly hosting

tasting sessions at local bottle shops. It’s a big challenge and marketing is certainly a key ingredient for success in the craft beer

game.”

dam says, “Running a brewery is not all beer and skittles. You simply can’t afford to make mistakes with any of the stages in

the brewing process (milling, mashing, lautering, boiling, fermenting, conditioning, filtering and packaging) and transporting your brew to a

supplier is another logistical challenge. Many breweries are local family based operations and because of their size they’re limited

in terms of where they can actually distribute their beers. Logistics can be a nightmare and life as an online retailer is certainly tough

but building up brand awareness is a stumbling block for many operators. It’s no surprise to find proprietors regularly hosting

tasting sessions at local bottle shops. It’s a big challenge and marketing is certainly a key ingredient for success in the craft beer

game.”

MARKETING YOUR BREWERY BUSINESS

Historically, breweries have relied on reputation and referrals to grow and while these remain important, in the digital age your online presence should be a priority. Increasingly local searches like ‘Breweries Melbourne’ are driving traffic to your website and in effect, your website is your silent salesperson open 24/7. It is often the first touch point with a potential new customer and you only get one chance to make a good first impression.

O

ne of our biggest points of difference with traditional accounting firms is our marketing expertise. We

can assist you with your branding (business name, logo and slogan) and help you create digital publishing collateral as well as harness the

power of social media to win more referrals. Over the past few years we have worked with dozens of clients to help them create affordable,

quality lead generation websites. We can provide advice and assistance with your content, video production and search engine optimisation.

We'll make sure your website is responsive to smart phones (click here

to check your current website) and we’ll help you develop lead magnets and calls to action. Not only that, we can help you launch a

re-marketing program and assist you to implement your social media campaigns to drive more traffic to your website.

ne of our biggest points of difference with traditional accounting firms is our marketing expertise. We

can assist you with your branding (business name, logo and slogan) and help you create digital publishing collateral as well as harness the

power of social media to win more referrals. Over the past few years we have worked with dozens of clients to help them create affordable,

quality lead generation websites. We can provide advice and assistance with your content, video production and search engine optimisation.

We'll make sure your website is responsive to smart phones (click here

to check your current website) and we’ll help you develop lead magnets and calls to action. Not only that, we can help you launch a

re-marketing program and assist you to implement your social media campaigns to drive more traffic to your website.

In a competitive market you need to work smarter, not harder. Some of the modern marketing tools and social media channels can accelerate your success and help you run some of your marketing on auto pilot. They can give you a serious competitive edge and if you aren’t using them to promote your business then you’re probably not going to reach your full profit potential.

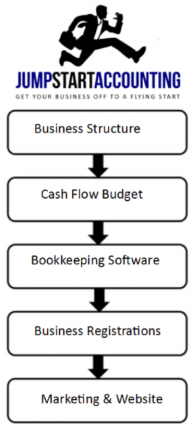

STARTING A BREWERY BUSINESS

When starting or buying into a brewery business there are numerous issues to consider. It can be a minefield but as business start-up specialists we can assist you with everything from your branding through to your business structure, site selection, commercial lease, corporate brochure, marketing and website. We have developed a number of tools specifically for new business owners including a comprehensive checklist of start up expenses broken down into categories including leasehold improvements, IT costs, marketing, plant and equipment (including brewing equipment). These figures then automatically feed through to an integrated cash flow budget to help you identify any finance requirements and they also tuck neatly into a business plan template we have created.

For a start-up brewery you need to carefully manage your costs including the purchase of brewing equipment and the associated utilities including fermenters, bright tanks and kegs. You need to source suitable premises to house your brewing operation and you need to budget on scaling up production from gypsy brewing to selling 1 million litres a year. At the same time you need to manage your federal, state and local government obligations with licensing for the sale and distribution of alcohol plus occupational health and safety responsibilities.

I t’s not easy and with heightened reporting requirements it’s no surprise to find many brewery owners are burning the candle at both ends. Financial management often takes a back seat and experience tells us that meeting the record keeping requirements can be a hurdle for brewery owners. As accountants we can assist you with all your GST, Excise, PAYG and superannuation compliance issues. We will help you select the most appropriate software for your brewery taking into account your business needs (bookkeeping, payroll, inventory, invoicing etc.) and level of accounting skill. Where required we will train you or your staff to use the software because we find many businesses owners make the mistake of buying sophisticated ‘double entry’ accounting programs that are beyond their needs and level of accounting skill. This leads to ‘computerised shoebox’ records and extra accounting costs when our client brief includes minimising the cost of compliance. We are an advocate for cloud accounting solutions and work with a number of programs including QuickBooks Online, Xero and Cashflow Manager.

t’s not easy and with heightened reporting requirements it’s no surprise to find many brewery owners are burning the candle at both ends. Financial management often takes a back seat and experience tells us that meeting the record keeping requirements can be a hurdle for brewery owners. As accountants we can assist you with all your GST, Excise, PAYG and superannuation compliance issues. We will help you select the most appropriate software for your brewery taking into account your business needs (bookkeeping, payroll, inventory, invoicing etc.) and level of accounting skill. Where required we will train you or your staff to use the software because we find many businesses owners make the mistake of buying sophisticated ‘double entry’ accounting programs that are beyond their needs and level of accounting skill. This leads to ‘computerised shoebox’ records and extra accounting costs when our client brief includes minimising the cost of compliance. We are an advocate for cloud accounting solutions and work with a number of programs including QuickBooks Online, Xero and Cashflow Manager.

W e’ll advise you on the most appropriate tax structure for your business and in the process take into account tax considerations, asset protection, family structures and eligibility for future discount capital gains tax concessions. If you need help with your commercial property lease or finance for your brewery equipment or vehicles (chattel mortgage, lease etc.) we can assist you.

e’ll advise you on the most appropriate tax structure for your business and in the process take into account tax considerations, asset protection, family structures and eligibility for future discount capital gains tax concessions. If you need help with your commercial property lease or finance for your brewery equipment or vehicles (chattel mortgage, lease etc.) we can assist you.

Most entrepreneurs want to grow their profits and their wealth which explains why a number of our clients have a self managed superannuation fund (SMSF) as part of their business structure. If you want to know more about starting a SMSF talk to us today or download our e-booklet, Thinking of Starting a SMSF.

W e strive to help you ‘know your numbers’ and that includes understanding the Four Ways to Grow Your Business. Once you understand the key profit drivers in your business we can talk you through profit improvement strategies and even quantify the profit improvement potential in your business. Of course, this is just the beginning because we can also do some financial modelling and help you prepare some ‘what if’ scenarios. This will give you projections based on best and worst case financial scenarios.

e strive to help you ‘know your numbers’ and that includes understanding the Four Ways to Grow Your Business. Once you understand the key profit drivers in your business we can talk you through profit improvement strategies and even quantify the profit improvement potential in your business. Of course, this is just the beginning because we can also do some financial modelling and help you prepare some ‘what if’ scenarios. This will give you projections based on best and worst case financial scenarios.

P reparing a cash flow budget and projecting your profit and loss statement is all part of our service offering and we use industry benchmarks to analyse and compare the relative performance of your brewery against your peers so you understand what is working in the business and what needs working on.

reparing a cash flow budget and projecting your profit and loss statement is all part of our service offering and we use industry benchmarks to analyse and compare the relative performance of your brewery against your peers so you understand what is working in the business and what needs working on.

Our services to breweries and start-up entrepreneurs are both broad and deep and include:

- Start-Up Business Advice for a Breweries

- Advice and Establishment of Your Business Structure

- Advice & Assistance with the Purchase or Sale of your Brewery Business

- Spreadsheets and Tools including a Start Up Expense Checklist and Pricing Calculator

- Tax & Business Registrations including your ABN, TFN, GST, WorkCover etc.

- Preparation of a Business Plan, Cash Flow Forecasts and Profit Projections

- Accounting Software Selection and Training – Bookkeeping, Invoicing, Payroll etc.

- Preparation of Finance Applications for Banking Institutions

- Site Location and Advice Regarding your Commercial Lease

- Preparation and Analysis of Financial Statements

- Bookkeeping and Payroll Services

- Tax Planning Strategies

- Industry Benchmarking and KPI Management

- Marketing Advice including branding, brochures, website and social media strategies

- Advice and Assistance with the Development, Content and Website SEO

- Wealth Creation Strategies, SMSF’s and Financial Planning Services

- Vehicle & Equipment Finance (including Brewing Equipment)

- Monitoring Labour Costs & Advice regarding Workplace Laws

- Advice regarding Claiming Motor Vehicle Costs

- Business & Risk Insurances

- Business Succession Planning

In summary, we work hard to understand your business and over the past decade breweries have become a niche area within our firm. If you’re looking to get your brewery business off to a flying start or you want to boost your current results, we invite you to contact us today on (03) 9575 3800 and book a FREE, one hour introductory consultation. You can expect practical business, tax, marketing and financial advice that could have a profound effect on your future business profits.